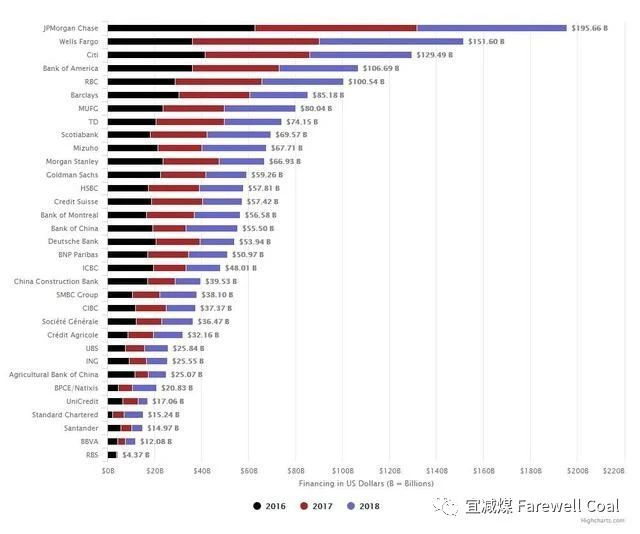

《气候变化银行融资2019》报告显示,自2015年底巴黎气候协议通过以来,33家全球银行向化石燃料公司提供了1.9万亿美元资金,并且过去两年中每年化石燃料融资额都有所增加。来源:电缆网

据Market Watch报道,作为全球最大的投资机构,摩根大通公司(JPMorgan Chase&Co.)将终止或逐步取消对某些化石燃料的贷款,包括北极钻探和煤矿开采,但其为全球主要石油公司提供的持续资金仍使环保主义者和股东团体感到不满。

JP Morgan Chase & Co. will end or phase out loans to some fossil-fuel interests, namely Arctic drilling and coal mining, but the ongoing funding of major oil firms by the world’s largest financier of fossil fuels still chafes environmentalists and shareholder groups.

摩根大通银行在2月25日举办的年度投资者日上宣布将推动2000亿美元的环境和经济发展交易。它将限制对新的燃煤电厂的融资,到2024年前逐步退出对该行业信贷投放,并将停止为新的石油和天然气钻探项目提供资金,以作为保护北极国家野生动物保护区的行动的一部分。

The bank said at its annual investor day on Tuesday that it will aim to facilitate $200 billion in environmental and economic development deals. It will put restrictions on financing new coal-fired power plants, phase out “credit exposure” to the industry by 2024 and stop funding new oil and gas drilling projects as part of protecting the Arctic National Wildlife Refuge.

根据雨林行动网络(Rainforest Action Network)的数据显示,摩根大通银行自2015年12月《巴黎协定》达成至2018年底之间,一共提供了1960亿美元的化石燃料项目资金。

The bank had provided $196 billion in funding of fossil-fuel projects between the December 2015 creation of the Paris climate agreement and the end of 2018, according to the Rainforest Action Network.